We are thankful for the relationship YOU, as a donor, have with Prairie, who see the purpose and value of supporting students studying at a post-secondary level to be Christ-centered, Bible-based, Discipleship-directed, and Mission-mandated.

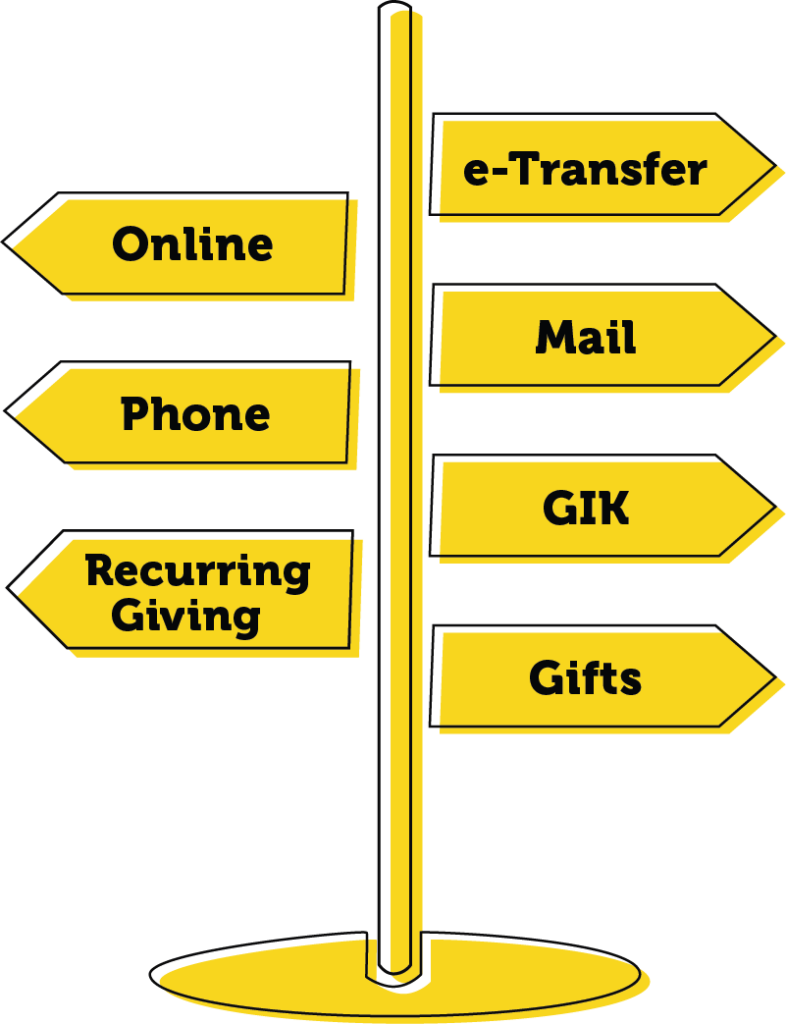

Here are key opportunities you can partner with Prairie.

We have launched our Campaign for Greater Impact to provide students with the very best learning opportunities and campus facilities for the decades ahead.

In Phase One of this Campaign, we plan to invest in much-needed campus renewal, including: upgraded Infrastructure, a new Student Residence, Cafeteria, Worship Auditorium, and expanded Aviation Training Centre. A modern campus requires an investment that is bold, and even expensive, but each Campaign Project is strategic, and designed to enhance Prairie’s campus and student life experience.

This expansion of PATC’s facility is a key project of Prairie’s Campaign for Greater Impact. It will increase the College’s capacity to train a new generation of Christian aviators to serve God in missions, and also address the growing need for trained pilots in the commercial aviation sector.

Invest in the next generation of missional professionals. Each year Prairie College distributes over $500,000 in scholarships and bursaries to students. We are grateful for each gift that reduces the burden of students’ tuition and allows students to fulfill their God-given professions.

Prairie College is educating students to pursue a Biblical foundation for life and career. Your contribution to this fund assists in minimizing the College’s general operating expenses.

We are grateful to offer many options for giving to Prairie. Click on the method of giving that works best for you. All donations greater than $10.00 will receive an official receipt for income tax purposes. Prairie is qualified to issue Canadian and American tax receipts.

Interact e-Transfers are only available for owners of a Canadian bank account. This may be a good option in lieu of mailing in a cheque or a credit card payment (with a processing fee).

When you request to make an e-transfer, ALL these pieces of information MUST be included on the “Message”/ “Memo” section of the transfer:

For an example of the e-transfer process, click here.

Notes:

You can send a cheque to Prairie at either of the following addresses. Please make cheques payable to Prairie Bible Institute.

Prairie College

PO Box 4000

Three Hills, AB T0M 2N0

US Donors can mail within the US to:

Prairie College

PO Box 718

Shelby, MT 59474

Use our secure online donation forms to donate in Canadian or US funds. We accept Visa or MasterCard.

Safe and convenient! In a few simple steps you can set-up a monthly gift and not have to worry about it again until you wish to stop. Please select one of the following two options:

Do you have a tangible asset (real estate or physical property) that you no longer need or you think would enhance Prairie’s program? Rather than sell the asset you could gift it. Prairie would be able to issue you a tax donation receipt for the sale value of the property or value determined by a qualified third-party appraisal. There are some ‘hoops to jump through’ and Canada Revenue Agency rules to follow, but we’ve done it before and would be happy to guide you through the process.

Talk today with Tim MacKenzie at legacyplanning@prairie.edu.

Donate in Memory of your Loved One

Thank you for honouring your loved one by choosing to make a donation to Prairie College. You can make your donation to the College using one of these options:

Donation via Cheque:

Donation via the College’s Website:

Take advantage of opportunities to enjoy both eternal and earthly rewards. Did you know that your investment in the lives of Prairie students can also benefit your family by providing tax benefits for your estate?

To learn more visit the Legacy Gift Planning page here or contact Tim MacKenzie, our Gift Planning Consultant for further information.

Spending of funds is confined to board approved programs and projects. Each restricted contribution designated towards a board approved program or project will be used as designated with the understanding that when the need for such a program or project has been met, or cannot be completed for any reason determined by the board, the remaining restricted contributions designated for such program or project will be used where needed most.

Prairie College educates students to be lovers of God, and likewise they multiply His love through making disciples, influencing culture, and building His kingdom in the ministry and careers the Lord calls them into.

Your giving to Prairie impacts students now and in the future. Thank you for being a part of the 100-year legacy that is continuing to grow.

Box 4000

Three Hills, AB T0M 2N0

Canada

Phone: 403.443.5511

TollFree: 1.800.661.2425

admissions@prairie.edu

info@prairie.edu

2024 © Prairie College

All rights reserved

Fall 2024 (September start), Winter 2025 (January start), and Online Education (start anytime) applications are open.

Prairie welcomes applications from individuals all around the world! To begin the International Student Application please click the link below.

If you are applying for the Master of Christian Ministry Leadership or the Master of Global Christian Educational Leadership please click the link below.

Tell us a bit about yourself and an admissions representative will be in touch shortly!

We have launched our Campaign for Greater Impact to provide students with the very best learning opportunities and campus facilities for the decades ahead.

In Phase One of this Campaign, we plan to invest in much-needed campus renewal, including: upgraded Infrastructure, a new Student Residence, Cafeteria, Worship Auditorium, and expanded Aviation Training Centre. A modern campus requires an investment that is bold, and even expensive, but each Campaign Project is strategic, and designed to enhance Prairie’s campus and student life experience.

This expansion of PATC’s facility is a key project of Prairie’s Campaign for Greater Impact. It will increase the College’s capacity to train a new generation of Christian aviators to serve God in missions, and also address the growing need for trained pilots in the commercial aviation sector.

Invest in the next generation of missional professionals. Each year Prairie College distributes over $500,000 in scholarships and bursaries to students. We are grateful for each gift that reduces the burden of students’ tuition and allows students to fulfill their God-given professions.

Encourage inmates in five institutions across Alberta to discover or reconnect with Jesus Christ. This fund assists the students studying the Certificate in Bible program with scholarships, resources for classes, and instruction.

Prairie College is educating students to pursue a Biblical foundation for life and career. Your contribution to this fund assists in minimizing the College’s general operating expenses.

To allocate your gift, please select one of the donation buttons below.